LONDON, May 16 (Reuters) – Automakers are accelerating efforts to use less palladium and more platinum due to worries over palladium supply from Russia, the World Platinum Investment Council (WPIC) said on Monday, predicting a large surplus in the platinum market this year.

Automakers were already shifting to platinum, which is cheaper than palladium, to save money, but a faster transition would increase platinum demand and could lift prices while having the opposite effect on palladium. ,

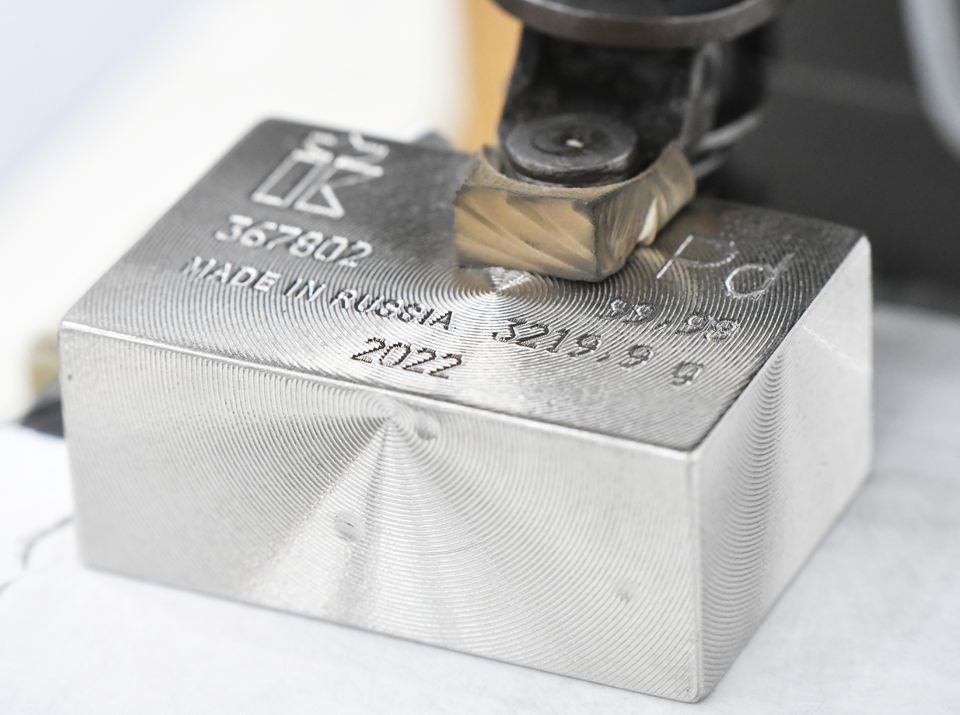

Russia accounts for around 25-30% of the world’s supply of palladium and around 8-10% of its platinum.

There is no sign that Russian exports have been curtailed by sanctions on the country since it sent troops into Ukraine in February but with the war dragging on, more companies may boycott Russian metal and governments could impose restrictions.

“The substitution effort has gone up hugely,” said Trevor Raymond, the WPIC’s head of research. “The amount of savings an automaker can make are massive. What’s been added on top of that is concerns about availability (of palladium).”

At around $950 an ounce, platinum costs around half as much as palladium. Automakers use around 2.5-3 million ounces of platinum each year and around 8.5 million ounces of palladium.

In its latest quarterly report, the WPIC said the roughly 8 million ounce a year platinum market would be oversupplied by 627,000 ounces this year following a surplus of 1.13 million ounces in 2021.

In March, it forecast a surplus for 2022 of 652,000 ounces.

During the January-March quarter, platinum demand fell 26%year-on-year and supply fell 13%, leaving the market oversupplied by 167,000 ounces, the WPIC said.

It said that for the full year, supply would be 5% less than in 2021 and demand would be 2% greater, with auto industry demand rising 16% due to an increase in light duty vehicle production, higher loadings per vehicle to meet tighter emissions regulation and substitution from palladium.

Following are supply and demand numbers and comparisons.

ANNUAL PLATINUM SUPPLY/DEMAND (‘000 oz)*

|

2021

|

2022f

|

2022f/2021 % change

|

|

|

SUPPLY

|

|||

|

Refined Production

|

6,297

|

5,872

|

-7%

|

|

Producer Inventory +/-

|

-93

|

0

|

-100%

|

|

Recycling

|

1,953

|

1,909

|

-2%

|

|

TOTAL SUPPLY

|

8,156

|

7,781

|

-5%

|

|

DEMAND

|

|||

|

Automotive

|

2,643

|

3,055

|

16%

|

|

Jewellery

|

1,923

|

1,886

|

-2%

|

|

Industrial

|

2,508

|

2,109

|

-16%

|

|

– of which chemical

|

688

|

613

|

-11%

|

|

– Petroleum

|

172

|

193

|

12%

|

|

– Electrical

|

135

|

127

|

-6%

|

|

– Glass

|

715

|

331

|

-54%

|

|

– Medical

|

244

|

257

|

5%

|

|

– Other

|

555

|

588

|

6%

|

|

Investment

|

-45

|

104

|

-331%

|

|

– Bars, Coins

|

332

|

254

|

-23%

|

|

– ETF Holdings

|

-238

|

-50

|

-79%

|

|

– Exchange Stocks

|

-139

|

-100

|

-28%

|

|

TOTAL DEMAND

|

7,029

|

7,155

|

2%

|

|

MARKET BALANCE

|

1,128

|

627

|

-44%

|

|

Above Ground Stocks

|

3,752

|

4,379

|

17%

|

QUARTERLY PLATINUM SUPPLY/DEMAND (‘000 oz)*

|

Q1 2021

|

Q4 2021

|

Q1 2022

|

Q1/Q1 % change

|

|

|

SUPPLY

|

||||

|

Refined Production

|

1,465

|

1,695

|

1,279

|

-13%

|

|

Producer Inventory +/-

|

-29

|

-39

|

0

|

-100%

|

|

Recycling

|

518

|

453

|

415

|

-20%

|

|

TOTAL SUPPLY

|

1,953

|

2,109

|

1,695

|

-13%

|

|

DEMAND

|

||||

|

Automotive

|

724

|

680

|

725

|

0%

|

|

Jewellery

|

479

|

499

|

437

|

-9%

|

|

Industrial

|

707

|

624

|

533

|

-25%

|

|

– of which chemical

|

119

|

200

|

111

|

-7%

|

|

– Petroleum

|

37

|

57

|

44

|

21%

|

|

– Electrical

|

33

|

32

|

30

|

-9%

|

|

– Glass

|

318

|

121

|

138

|

-56%

|

|

– Medical

|

57

|

67

|

65

|

15%

|

|

– Other

|

143

|

147

|

144

|

0%

|

|

Investment

|

159

|

-108

|

-167

|

-205%

|

|

– Bars, Coins

|

21

|

95

|

60

|

192%

|

|

– ETF Holdings

|

105

|

-155

|

-169

|

-261%

|

|

– Exchange Stocks

|

33

|

-48

|

-58

|

-273%

|

|

TOTAL DEMAND

|

2,069

|

1,695

|

1,528

|

-26%

|

|

MARKET BALANCE

|

-116

|

413

|

167

|

-244%

|

* Source: World Platinum Investment Council, Platinum Quarterly Q1 2022