Source : PTI | New Delhi: Sona BLW Precision Forgings is “actively” looking to enter the complex and competitive Chinese auto component market. This marks an about turn from what the company had said just a few quarters back – it had then pooh poohed the threat from the Chinese while pointing towards protectionist policies of the US and Indian governments and made no move to identify Chinese OEMs for supplying its own products. At that time, Sona had asserted that it was well placed to compete with the Chinese in the global automotive market. But since then, the global heft of the Chinese has increased, the US is in the midst of sweeping policy realignments and perhaps the motto – if you can’t beat them, might as well join them – best fits Sona’s current strategy.

In a post-results conference call after declaring the third quarter numbers for FY25, MD and Group CEO Vivek Vikram Singh said, “We are actively looking at how to get into China. But anything that I can say will be premature at this stage. Let us have something concrete and of course, the moment we do, we will share with everyone.” Acknowledging that China is a huge automotive market, Singh said it is also a challenging one. “It is not that simple a market. It has challenges in pockets, it has challenges in terms of fragmentation, in terms of supply chain distribution, it has geographic location challenges. So it is not a simple market. But then if we think of ourselves and hopefully we are a good management team, we are entrusted to do the things that are difficult.”

A Mumbai-based brokerage noted that two-thirds of Sona’s revenues currently accrue from North America and Europe while just about a fourth come from India. The move to tap Chinese OEMs is positive, it said, adding that within five years, more than half of Sona’s revenue will originate from eastern markets as light vehicle sales in US and Europe are projected to decline. But China’s electric vehicle market is thriving, with sales of EVs, plug-in hybrids and extended-range vehicles increasing by 50% in 2024. ”With healthy orderbook and diversification efforts, the company is poised for a robust growth journey going forward,” this brokerage said.

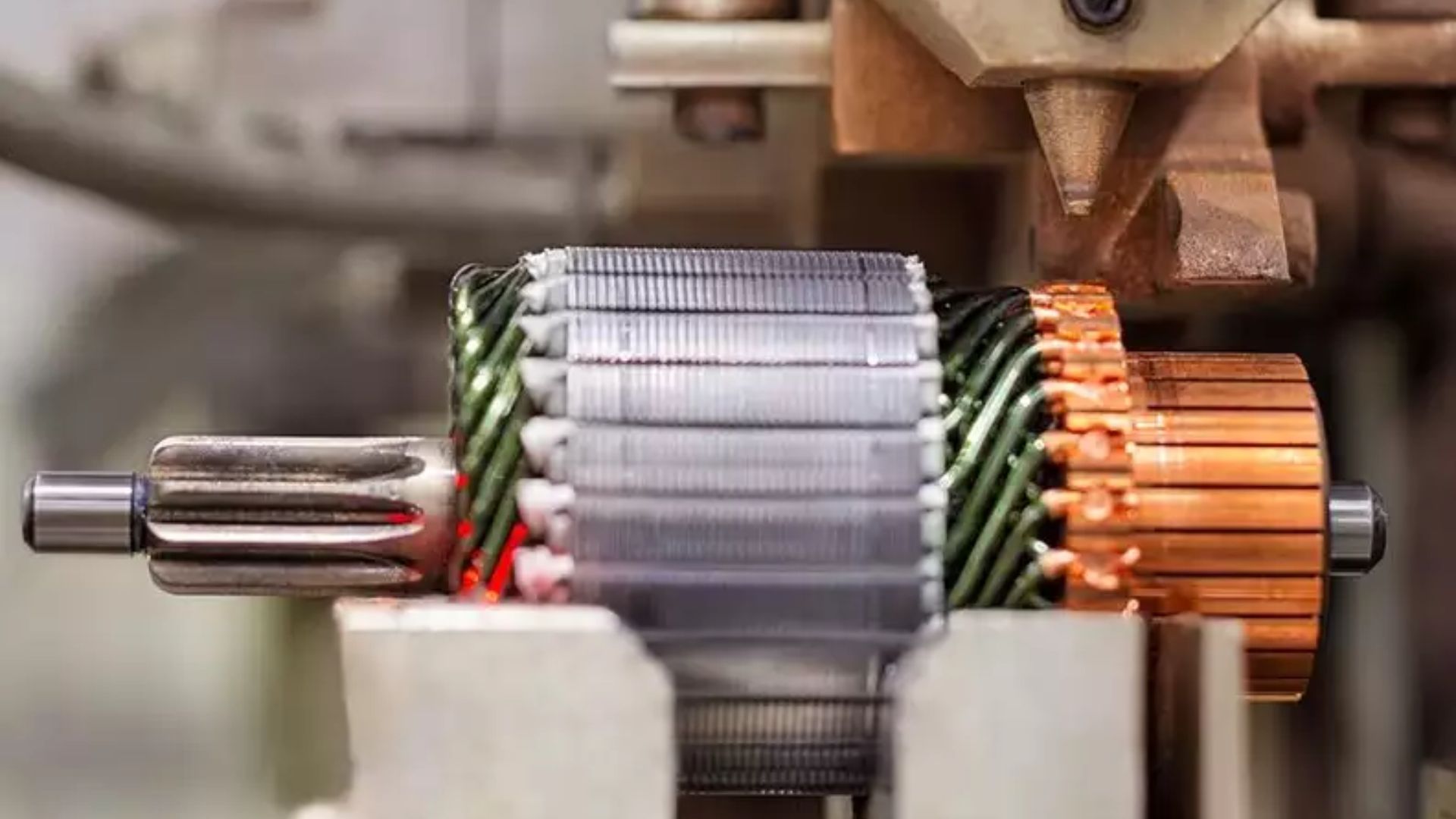

Sona wants to be electric-first in China, like in every other market it operates in. Singh said Sona had shut down its starter motor line one-and-a-half years ago in China to focus only on suspension motors because the company realized that it makes no sense to have an ICE product in that market. Sona changed the product mix at its Chinese manufacturing facility after realising that China is witnessing strong growth in EV penetration as ICE vehicles decline. “EV makers are what we would desire more (in China), but we are open to working with any OEM which gives us an opportunity,” Singh said.

Highlighting the low penetration of driveline products in China, he went on to say that high import duties imposed by China (8-10%) have meant that some part of the product has to be made in China. “We have to figure that puzzle out…it is on our radar”.

Mexico and US tariff threat:

A large portion of Sona’s revenues currently come from the US market and it had recently established a manufacturing plant in Mexico to primarily service customers in America. Singh dismissed any potential threat to the US business from the dramatically altered and aggressive tariff policies of the new Trump administration, calling the new policy paradigm an opportunity instead.

“I frankly think that we are misreading this situation. It could be a great opportunity for India, with the dollar-rupee decline currently… if you have to source (auto components), where would you source this from? Because making these parts in the US is not going to be possible. It will take far too long and it will be far far more expensive even with the duty thing. So I think its a far smaller risk for auto components. I think where all of this is stemming from is the differential in duties between cars in India and US that India imposes a hundred percent import duty on auto. It is not the same for auto components. There is not that much of a duty difference. So that’s my take on it. We don’t think its as big a risk as its been made out.”

Meanwhile, talk of Sona’s imminent entry into China, the world’s biggest electric vehicle market, comes after it has posted continuous growth in its battery electric vehicle (BEV) business, quarter on quarter, despite a slowdown in EV sales globally. Sona provides mission critical systems for electrified and non electrified powertrains to BEVs as well as ICE vehicles, in India and many markets across the world. For the nine-month period ending December 31, 2024, Sona’s BEV revenue grew by over 50% across its key markets of North America, Europe and Asia while the growth was 48% in absolute terms. Revenue from the BEV segment now accounts for 39% or more than a third of overall revenue.