by CA Jatin Minocha

Direct Tax Related Changes

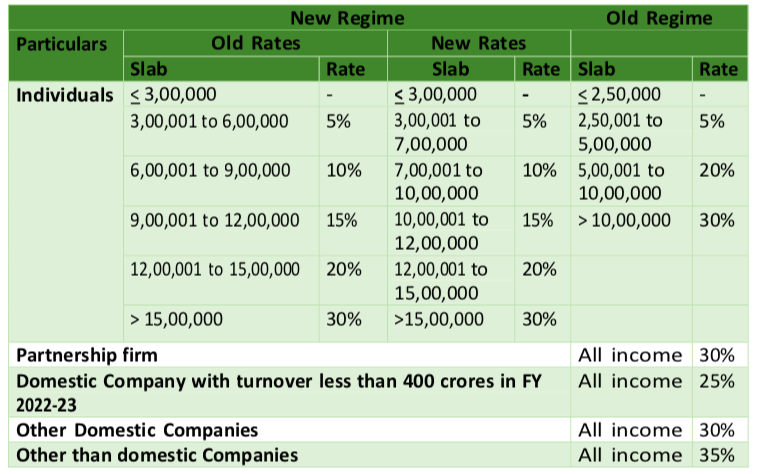

1. Tax Slabs tweaked and rates redefined:

Tax Rate for Assessment Year 2025-26 and Financial Year 2024-25

NOTE: (Standard deduction for salaried people under section 16(ia) has been enhanced from Rs.50,000 to Rs.75,000 only in new regime. If old regime is opted the standard deduction will be capped at Rs.50,000)

2. Introduction of TDS on Partners’ Remunerations

A new section 194T is inserted to propose TDS at the rate of 10% for payment of salary, remuneration, Commission, Bonus and interest to partners by the partnership firm if such payment exceeds Rs.20,000 in a year.

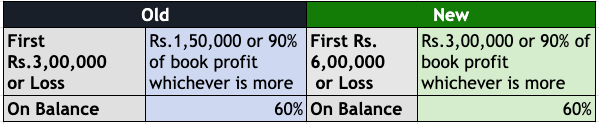

3. Increase in Partners’ Remuneration

The partners’ remuneration is capped as per the Income tax Act , 1961 section 40(b) the limits fixed earlier and the current limit from the financial year 2024-25 are as follows

4. Changes in taxation of Capital Gains on Equities

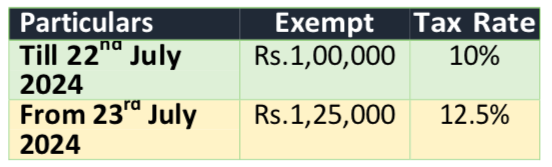

LONG TERM CAPITAL GAINS:

The taxation of long term capital gains on Equities have undergone a significant make over. LTCG on Equity Shares u/s. 112A Increased to 12.5% from 10%. LTCG Exemption on Equity Shares u/s 112A Increased to 1.25 Lacs from 1 Lacs

SHORT TERM CAPITAL GAINS

Tax rate on STCG on Eq Shares u/s 111A Increased to 20% from 15%. The short term capital gain on sale of Equity shares were taxed at 15% earlier with effect from 23rd July 2024 the rate of tax is increased to 20%.

Short-term gains on certain financial assets to be taxed at 20%.

FINANCIAL AND NON FINANCIAL ASSETS

Long-term gains on all financial and non-financial assets to be taxed at 12.5%

Listed financial assets held for more than a year to be classified as long- term

LTCG on all Other Assets. Reduced from 20% to 12.5%

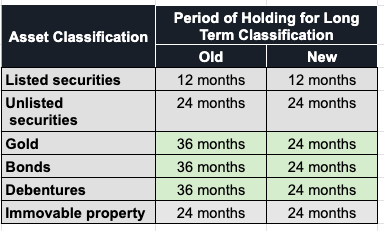

5. Holding period for Long term asset

Changes have been proposed for the holding period necessary to consider an asset as long term or short term asset. Gains from assets held as long term are taxed at lower rates than the assets held for short term. Only two holding periods classified as 12 and 24 months

Gold, debentures, bonds will be 24M (along with unlisted shares and RE) and All listed securities (incl bonds) will be 12M

Assets Period of Holding Classification for Long term classification

6.No More Indexation benefit

Whenever there were long term capital gains the taxpayer was allowed to increase cost of the asset to adjust for inflation. From 23rd July 2024 the capital gains will be calculated without any adjustment for inflation. The rate of tax on Long term capital gains have been reduced from 20% to 12.5%.

Property values indexed up to 2001 are grandfathered for capital gains: FM clarifies the abolition of indexation benefits in calculating capital gains tax on real estate and property will not affect everyone.

Old properties held before 2001 would continue to get indexation benefits. Legacy assets and old properties will benefit.

7. Securities Transaction Tax:

STT on Futures increased to 0.02% from 0.0125%

STT on Options increased to 0.1% from 0.0625%

STT rate change effective from 1st Oct 2024

8. Angel tax not to be levied

The Income Tax Act , 1961 section 56(2)(viib) provides

consideration received for issue of shares of a company in which public is not substantially interested exceeds the face value and the fair market value of the shares , consideration minus Fair Market value Will be taxed in hands of the company as income from other source. The tax has been removed now.

9. Buy back of shares income will be taxable for Recipient

Earlier , when shares were bought back, the domestic companies had to pay tax under 115QA at the rate of 20% and the gain on such buy back was exempt in hands of taxpayers as per section 10(34A) of the income tax Act,1961.

With effect from 01st October 2024 all the amount received as buy back from the company will be treated as dividend and will be taxed fully in the hands of the investor.

The Cost of Acquisition of the shares will be considered as capital loss and can only be set off against capital gains if any.

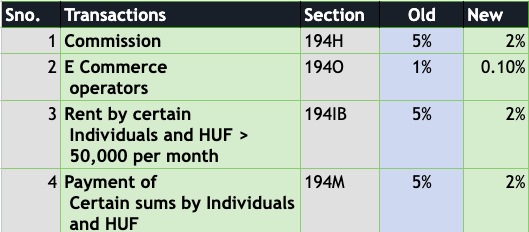

10.Significant Changes in Rates for TDS

The TDS rates have been changed for the following transactions with effect from 01st October 2024

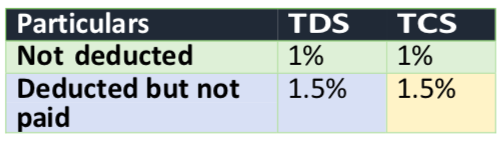

11.Increase in Rate of Interest under TCS and TCS on Luxury Goods

The rate of interest per month for TDS and TCS before the amendment presented in the Finance Bill ,2024 is as follows

To align with TDS interest rates if the TCS collected is not deposited with the government the rate of interest is increased from 1% to 1.5%

Sec 206C(1F) has been amended to give government the power to

notify luxury goods on which TCS at 1% may be levied if value exceeds Rs.10 lakhs

12.Custom Duty exemption on the following items as part of Indirect tax

a Exemption of 3 medicines for cancer from custom duty

b Reduction of BCD on medical equipment like X-Ray machine tubes

c BCD reduced to 15% on mobile phones, parts and chargers, etc.

d Exemption of custom duty on 25 rare earth minerals

e Exemption on capital goods for manufacturing of solar panels

f To boost seafood exports, reduced BCD on shrimp, fish, broodstock to 5%

g Reduce BCD on leather, textiles, footwears made of leather and other leather products

h Mythelene, dye, yarn duty reduced from 7.5% to 5%

I Precious metals such as gold and silver, custom duty reduced to 6% custom duty reduced to 6.4% in case of platinum

j BCD on copper and nickle is removed.

About the Author

The Author is a renowned Chartered Accountant of India. His name is Jatin Minocha.

CA Jatin Minocha, Fellow Chartered Accountant, Associate member of CPA Australia, MBA(Finance) , Author of around 500 Tax related articles on various web portals like Tax guru and Taxonation

He brings with him more than 25 years of taxation, audit, advisory and consulting experience and has a team of banking , legal and accounting professionals giving holistic advisory to all his clients

CA Jatin Minocha and his Team are always “Happy to Help and Guide”!

Contact details

99115-41774, 95822-24324

Email – minochajatin@yahoo.co.in Website – Cajatinminocha.com