“Owing to a supply constraint of electronic components due to the semiconductor shortage situation, the Company is expecting an adverse impact on vehicle production in the month of September in both Haryana and its contract manufacturing company, Suzuki Motor Gujarat Pvt. Ltd. (SMG) in Gujarat,” Sanjeev Grover, Vice President and Company Secretary, said in a statement. He also added, “Though the situation is quite dynamic, it is currently estimated that the total vehicle production volume across both locations could be around 40% of normal production”.

-

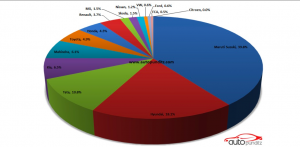

Maruti Suzuki recorded the highest drop in Market Share YoY and the volumes fell by 8.7 percent in Aug’21 v/s Aug’20. Do note that the Industry registered a YoY increase of 10.9 percent.

-

Hyundai India sales increased 2.3 percent YoY and fell 2.4 percent MoM. Hyundai’s Market Share dropped to 18.1 percent in Aug 2021 against 19.6 percent in Aug 2020.

-

Tata continues to perform well (source) and has been able to stabilize at the No.3 position. It gained the highest Market Share in Aug’21 over last year and has seen great traction for all its models. Tata will now be vouching to lessen the gap with Hyundai post the launch of the upcoming Punch mini SUV.

-

Kia regained the fourth rank and sales increased over 54 percent YoY and 11.5 percent MoM.

-

M&M volumes grew 17.7 percent in Aug 2021 over Aug 2020 and was placed at the fifth spot in the ranking table. The Indian automaker had a very successful showcase of the XUV700 and is poised to grow significantly if it is able to garner volumes for the model.

-

Toyota overtook the likes of Renault, Ford, and Honda to place itself in the sixth spot. Innova alone contributed to over 45 percent of Toyota’s sales in Aug 2021!

-

Renault sold 9,703 units of its cars in Aug 2021 compared to 8,060 units in the same period last year. The majority of sales for Renault come from Kwid, Triber, and Kiger.

-

Honda sales jumped to 11,177 units in Aug 2021. The New Amaze pulled volumes for the OEM and contributed to over 58 percent of HCIL’s sales in Aug’21.

-

MG sold 3,900 units in Aug 2021 compared to 2,851 units in Aug 2020. MG is now gearing up for the launch of its Creta-rivalling Mid-SUV, Astor soon.

-

Škoda overtook Nissan and VW to record 3,829 units dispatches! The New Kushaq has done wonders for the brand and contributed to over 75 percent of the OEM’s volume!

-

Backed by Magnite’s success; Nissan sold 3,209 units in Aug 2021, compared to a dismal 810 units in Aug 2020, and helped the OEM record the highest YoY growth last month.

-

Ford slipped to the 13th position and registered the highest YoY degrowth in August 2021.

-

Citroen’s entry in the Indian market with C5 Aircross now seems to be timed wrongly. The brand could sell only 50 units in Aug’21 and needs to bring the Sub-4m Compact SUV soon!