LONDON, Jan 27 (Reuters) – An era of breathtaking palladium rallies is likely to be ending, analysts said, as rising supply and stagnant demand erode prices of the metal used to neutralise vehicle exhaust emissions.

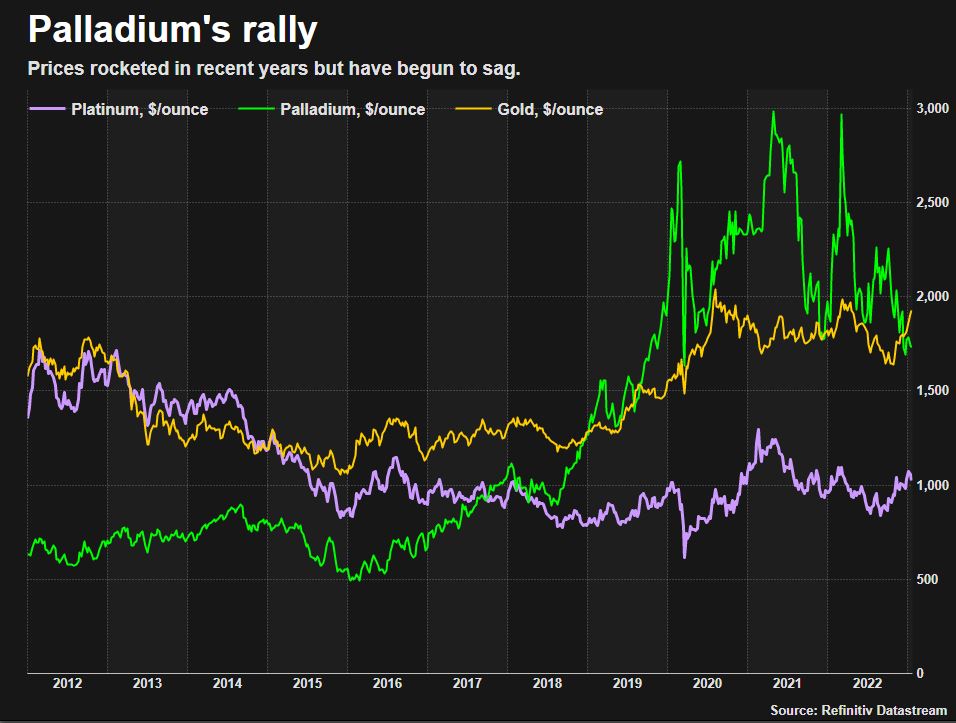

Palladium , once the cheapest major precious metal, rocketed from less than $500 an ounce in 2016 to above $3,400 last March, leaving platinum and gold for dust.

Charting palladium prices alongside gold and platinum.

Powering the rally was rising demand from automakers who needed more palladium per vehicle to meet tightening emissions standards. Supply could not keep up, leading to huge deficits.

That is now changing.

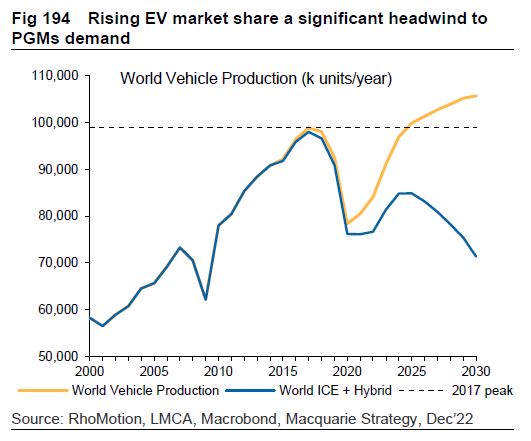

Electric vehicles (EVs) that do not need palladium are gaining market share and automakers are substituting some palladium for cheaper platinum in combustion engine vehicles.

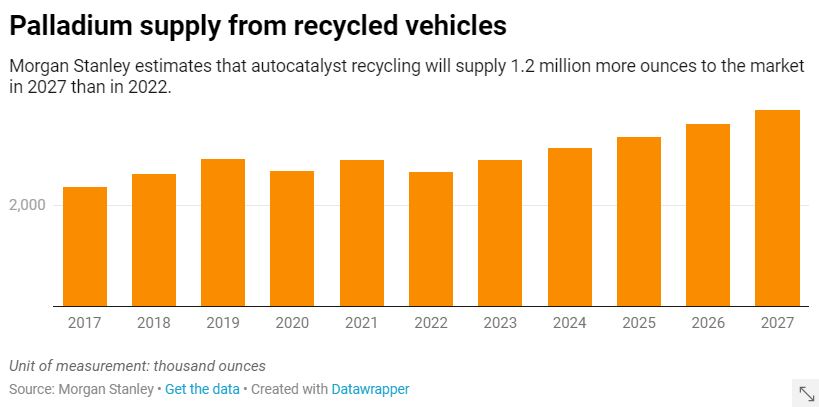

Meanwhile, supply from recycled cars is rising as those containing more palladium reach the end of the road.

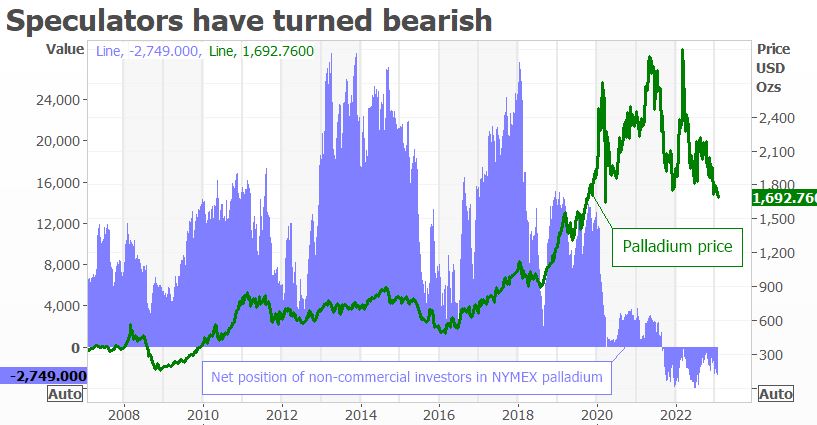

Palladium has dropped to around $1,700 an ounce.

“We see prices coming down gradually every year,” said Michael Widmer, an analyst at Bank of America. “Palladium is a one trick pony. Demand relies pretty much 90% on the auto industry.”

Analysts at Macquarie predicted prices would average just $1,150 an ounce in 2027.

Rising EV production is a headwind to palladium demand.

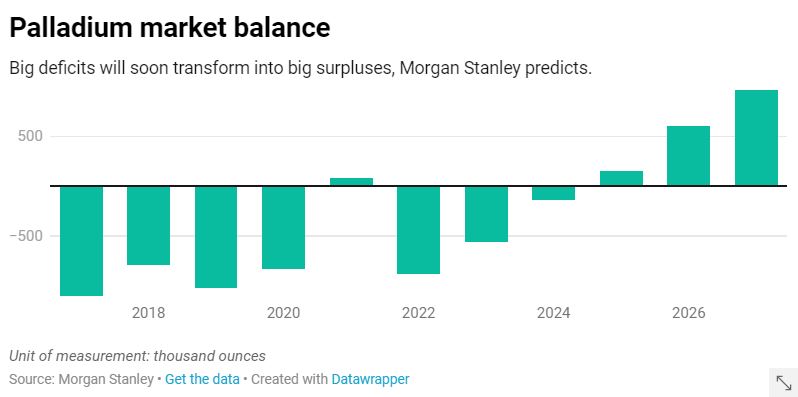

Demand from automakers will fall by around 400,000 ounces between 2022 and 2027, while supply from recycling of vehicles will increase by 1.2 million ounces, analysts at Morgan Stanley forecast.

Supply is expected to grow significantly in the coming years.

That will shift the roughly 11 million ounce a year market to a surplus of nearly a million ounces in 2027, they said.

Big deficits will turn into big surpluses in the coming years.

But it is too early to rule out short-term upward moves.

Macquarie sees demand from automakers rising this year and next and no palladium oversupply until 2025.

Russia’s Norilsk Nickel (GMKN.MM), which accounts for 40% of global mine supply, said on Tuesday its palladium output would fall 8%-14% this year, which could tighten the market.

Prices surged last year due to fears of sanctions on Norilsk’s palladium after Russia invaded Ukraine. Uncertainty around supply remains as long as the war continues, said Jacob Smith at consultants Metals Focus.

“If there’s any constraints on that (supply from Russia), you’ll definitely see a spike,” he said.

Speculators have turned bearish on NYMEX palladium futures.

Reporting by Peter Hobson; Editing by Alexander Smith