by Mark Prakash

The rise & requirements of Telematics has spread its wings across a plethora of industries and market segments such as Transportation, Health care, Electric vehicle segment, Government Compliance and many more! The latest industry to have caught on the numerous benefits of incorporating Telematics into is the vehicle Insurance sector.

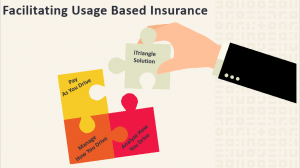

Vehicle owners will very soon be able to purchase tailormade Analytics-based insurance which will focus on individual’s driving behaviors and will follow a ‘pay as you drive’ policy which will revolutionize the Vehicle insurance sector and provide numerous benefits to the Vehicle owners as well as insurance companies to get a better understanding and an opportunity to get information much more effectively and efficiently.

The insurance regulatory and development authority of India (IRDAI) has made a statement that “As a step towards facilitating technology enabled covers – the IRDAI has permitted the general insurance companies to introduce tech-enabled for the motor own damage (OD) cover” and this is where the iTriangle solution has come into place to bridge the gap between Technology and the Insurance sector.

Being the pioneers in Telematics industry for over a decade and proactively introducing instrumental Telematic solutions for several prominent market segments, iTriangle has decided to assist the Vehicle insurance industry to combat the issue and commit towards the progression of a new age Digital India.

The iTriangle solution provided will entirely assist the End user of the vehicle as well as the insurance company in managing, analysing, and recording driving patterns and seamlessly transfer crucial data (in accordance with the data privacy laws of the land) which can be used towards the formulating custom insurance policies based on the ‘pay as you drive’ philosophy and reduce costs for the both the parties.

The DGM (Sales & Marketing) of iTriangle, Harshit Mathur has brilliantly summarized the requirement and benefits of our Vehicle Insurance based solution by stating that “The iTriangle solution will greatly benefit both the parties as the end user will only have to pay according to their driving pattern and will be charged much more economically. From the point of view of the insurance companies, the solution will help them to bring the claim ratio under control. Apart from motivating the driver to improve the quality of driving, Commercial vehicles can also take advantage of the iTriangle solution as they can seek insurance based on their specific usage.

Advertising & Marketing companies can also take advantage of our solution by introducing location based targeted advertisements which can conveniently focus on the end user’s location and vehicle requirement such as advertisements of petrol bunks and service centres”.

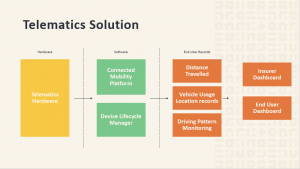

iTriangle also has a robust connected mobility platform that consists of:

- Complete telematics solution

- Driving pattern and behaviour analysis

- Complete vehicle diagnostics on CAN and Kline with a host of additional exciting features

iTriangle will efficiently bring in usage-based insurance solutions which will hit a bullseye on the target and provide a 360 ° answer in obtaining detailed information on driving behaviour and pattern. Even though the pandemic had temporarily slowed down the progress of telematics entering the Insurance industry, important developments have taken on ensuring the progress of digitalization of processing data of the vehicle and with iTriangle ready to provide its unique key offerings in obtaining driving behaviour analytics, crash alerts and vehicle damage reports, the vehicle Insurance industry will obtain numerous advantages of the iTriangle solution.

Innovating, optimizing, and delivering the best in the field of Telematics has always been the mantra of iTriangle and the organization is ready to blossom in the mission of developing India to digitally compete with the rest of the world!

Vadiraj Katti, the Co-Founder and Managing Director of iTriangle also feels that this decision of IRDA to allow tech enabled concepts for Own Damage cove in Motor Insurance policies will be a game changer and will herald a massive change in the way vehicle insurance is looked at by the customers. He feels that, not only will this increase market penetration for Insurance companies, Telematics coupled with AI and Data Analytics will also help Insurers to augment product innovation and thus pass on the benefits to customers. “The era of one solution fit all is over….” he speaks.