Key Highlights from Q1 (April–June 2025)

a) Passenger vehicles

- Passenger Vehicle sales again crossed the 1 million mark in Q1 of 2025-26 (1.01 million units), it is the 2nd time in a row in Q1 in last 2 years. Due to lower sales in the later part of the quarter, sales in Q1 were lower by (-)1.4% as compared to Q1 of 2024-25.

- The share of Utility Vehicles (UVs) in the Passenger Vehicle segment has now grown to 66%. UVs have posted a growth of 3.8% in Q1 of 2025-26, over Q1 of 2024-25, while the Passenger Cars segment has degrown by (-) 11.2% over Q1 of 2024-25.

- Passenger Vehicles saw their highest ever exports in Q1 of 2025-26 of 2.04 Lakh units registering a growth of 13.2% over Q1 of 2024-25.

- Export growth in this segment was driven by stable demand across most markets, with strong performance in the Middle East and Latin America. Revival in neighbouring markets like Sri Lanka and Nepal, rising demand from Japan, and growing exports under FTAs such as Australia also contributed to the overall uptick.

b) Two-Wheelers

- The Two-Wheeler segment posted sales of 4.67 million units in Q1 of 2025-26, resulting in a de-growth of (-) 6.2%, as compared to the same period of last year, as there was some inventory correction in the Industry.

- While the wholesale sales declined, 2W retail registration increased by 5% in Q1 driven by marriage season and positive demand sentiments.

- The share of scooter segment in Two-Wheelers increased in Q1 FY2025-26 over last year by 2.15%.

- Although still below the peak of 2022-23, exports of Two-Wheelers registered 1.14 million units with a considerable growth of 23.2% in Q1 of 2025-26, over Q1 of last year. This growth was driven by a revival in neighbouring markets and continued growth momentum across key export markets

c) Three Wheelers

- In Q1 of 2025-26, Three-Wheelers posted its highest ever Q1 sales of 1.65 Lakh units in 2025-26, with a marginal growth of 0.1%, especially driven by the Passenger Carrier sub-segment.

- Sustained performance of Three-Wheeler segment is driven by factors including increased economic activity supporting transportation creating urban demand.

- The retail registration of cargo segment continues to grow well reflecting the increased demand for intracity low load cargo.

- Easier financing options also helped in supporting this momentum.

- 0.96 Lakh units of Three-Wheeler were exported with a growth of 34.4% in Q1 of 2025-26, as compared to last year’s Q1.

d) Commercial Vehicles

- In Q1 of 2025-26, Commercial Vehicles posted a marginal degrowth of (-) 0.6% compared to Q1 of last year, with sales of 2.23 Lakh units.

- Within the Commercial Vehicle segment, though the Passenger vehicle segment posted growth indicating continued momentum in public transportation, however, the Goods segment has shown a slight degrowth.

- Exports of Commercial Vehicles posted a good growth of 23.4% in Q1 of 2025-26 with exports of around 0.2 Lakh units, as compared to Q1 of last year.

Growth Outlook for Q2 (July – Sept 2025)

• Looking ahead to Q2, the overall industry outlook remains cautiously optimistic. While the challenges from Q1 may continue to linger in the near term, several positive macroeconomic and seasonal indicators could support a gradual recovery:

- The upcoming festive season typically serves as a demand driver, particularly for Passenger Vehicles and Two-Wheelers, and could help uplift consumer sentiments.

- An above-normal monsoon is likely to aid rural income recovery, which is especially important for Two-Wheelers and entry-level vehicles that rely heavily on rural demand.

- The RBI’s cumulative repo rate cuts of 100 basis points over the past six months are expected to gradually ease borrowing costs which could positively impact the Auto sector by improving affordability and boosting consumer sentiment in the coming months.

• However, the supply side challenges, especially the recent export licensing requirement from China on rare earth magnets, has been a concern for OEMs of all categories.

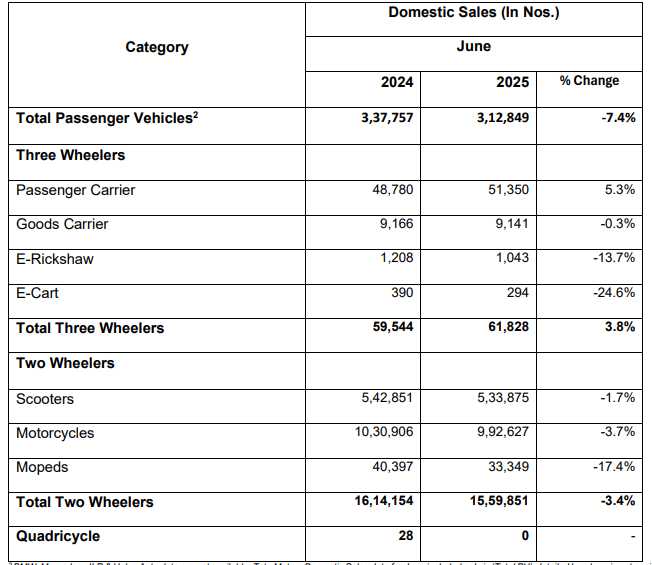

Monthly Performance: June 2025

Production: The total production of Passenger Vehicles1 , Three Wheelers, Two Wheelers and Quadricycle in the month of June 2025 was 23,64,868 units

Domestic Sales:

- Passenger Vehicles2 sales were 3,12,849 units in June 2025.

- Three-wheeler sales were 61,828 units in June 2025.

- Two-wheeler sales were 15,59,851 units in June 2025.

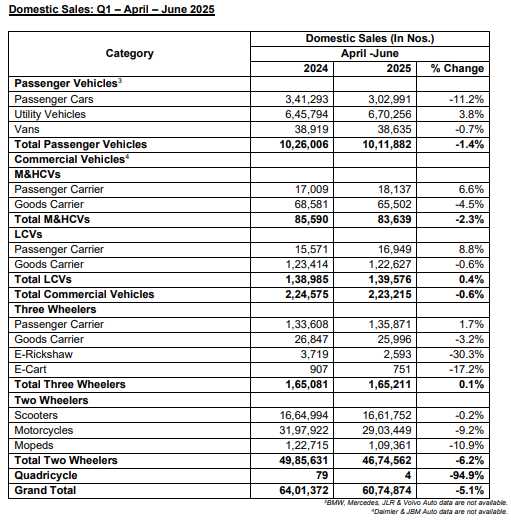

Quarterly Performance: Q1-April – June 2025

Production: Total production of Passenger Vehicles3 , Commercial Vehicles4 , Three Wheelers, Two Wheelers and Quadricycle in April – June 2025 was 76,60,225 units.

Domestic Sales:

- Passenger Vehicles3 sales were 10,11,882 units in April – June 2025.

- Commercial Vehicles4 sales were 2,23,215 units in April – June 2025.

- Three-wheeler sales were 1,65,211 units in April – June 2025.

- Two-wheeler sales were 46,74,562 units in April – June 2025.

Commenting on sales data of Q1 of 2025-26, Mr Shailesh Chandra, President, SIAM said,

“The performance of the Auto industry was relatively flat, though the retail registration for Passenger Vehicles, Two-Wheelers and Three-Wheelers were marginally higher than the previous Q1. Overall sentiments across categories have remained subdued so far, even as the industry continues to navigate supply side challenges. With the upcoming festival season coupled with the benefits of RBI repo rate cuts, we expect consumer sentiments to improve.”

Commenting on the performance of Q1 of 2025-26, Mr Rajesh Menon, Director General, SIAM said, “Sales of Passenger Vehicles in Q1 of 2025-26 de-grew by (-) 1.4%, posting sales of 1.01 million units as compared to Q1 of previous year. Sales of Three-Wheelers in Q1 of 2025-26 grew marginally by 0.1% compared to last year, with 1.65 Lakh units, which is the highest ever in Q1. Two-Wheelers registered a de-growth of (-) 6.2% in this Quarter, compared to last year, with sales of 4.67 million units while Commercial Vehicles de-grew marginally by (-) 0.6% in Q1, compared to Q1 of last financial year, with sales of 2.23 Lakh units.”