by WAF Think Tank

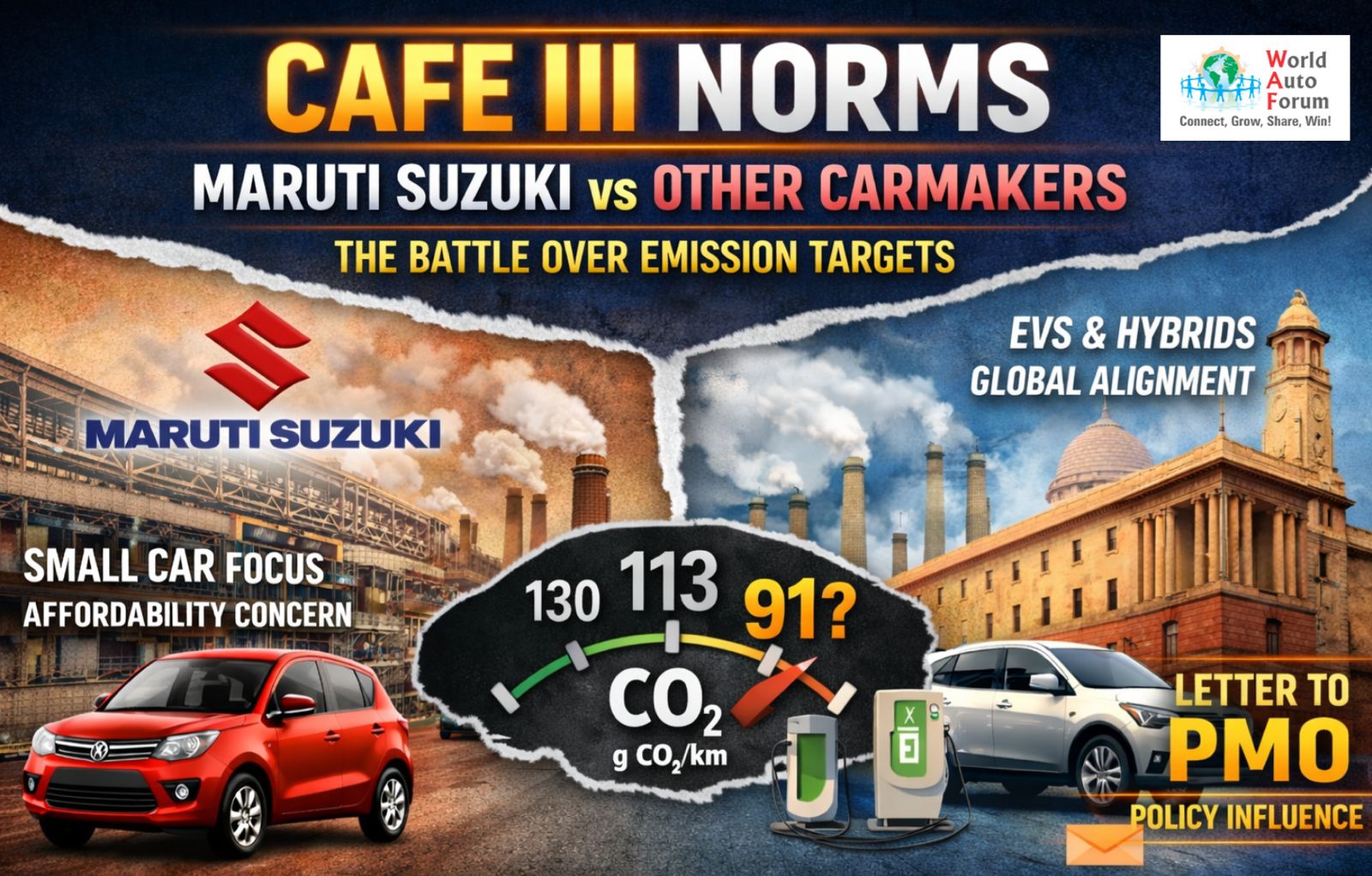

India’s proposed CAFE III (Corporate Average Fuel Efficiency) norms—expected to apply from FY 2027 onward—have triggered a rare and public divergence within the auto industry. Maruti Suzuki India, the country’s largest carmaker, has written to the Prime Minister’s Office (PMO) seeking a review of the draft framework, while several other manufacturers appear broadly aligned with the regulator’s direction.

What are CAFE III norms?

CAFE norms mandate that a manufacturer’s fleet-wide average CO₂ emissions remain below a specified threshold. Each new phase tightens limits, pushing companies toward lighter vehicles, cleaner powertrains, hybrids, and EVs. CAFE III is expected to be significantly more stringent than CAFE II.

📊 CAFE Norms – Numbers at a Glance (India)

✅ CAFE I (Already implemented)

-

Period: FY 2017–2022

-

Fleet CO₂ target: 130 g CO₂/km

✅ CAFE II (Current)

-

Period: FY 2022–2027

-

Fleet CO₂ target: 113 g CO₂/km

-

Reduction vs CAFE I: ~13%

🚗 CAFE III (Proposed / Draft Stage)

🔴 Expected Period

-

FY 2027 – FY 2032

🔴 Proposed Fleet CO₂ Targets

Different drafts suggest two possible ranges:

🔹 Conservative proposal

-

~95 g CO₂/km

-

Reduction of ~16% from CAFE II

🔹 Aggressive proposal (most discussed)

-

~91 g CO₂/km

-

Reduction of ~19–20% from CAFE II

📉 That means:

-

130 → 113 → ~91 g CO₂/km

-

~30% total reduction from CAFE I to CAFE III

⚖️ Why These Numbers Are Controversial

Impact on Vehicle Types

| Vehicle Type | CO₂ Impact |

|---|---|

| Small petrol hatchback | ~100–110 g/km |

| Compact SUV (petrol) | ~120–140 g/km |

| Strong hybrid | ~75–90 g/km |

| EV | 0 g/km (with credits) |

👉 Under ~91 g/km, even small petrol cars struggle unless supported by:

-

EV credits

-

Hybridisation

-

Super credits / flexibilities

🔢 Penalties (Expected Structure)

While exact penalties are pending, based on CAFE II:

-

₹25,000 per g/km per car (indicative)

-

Could rise under CAFE III

-

Calculated on fleet average exceedance × total production

This is why OEMs fear thousands of crores in penalties.

🧮 Why Maruti Suzuki Is Most Impacted (Numerically)

-

~65–70% sales = small ICE cars

-

Limited EV volumes till now

-

Small cars already close to physical efficiency limits

-

Less “headroom” to offset fleet averages

Whereas:

-

OEMs with SUVs + EVs + hybrids can average out emissions

Maruti Suzuki’s position

Maruti Suzuki’s core concerns, as conveyed to policymakers, include:

- Disproportionate impact on small-car makers:

With over 65% of Maruti’s sales from small, affordable cars, the company argues that steeper cuts under CAFE III penalise manufacturers focused on mass mobility rather than larger, higher-priced vehicles. - Limited EV credit headroom (near term):

Maruti has been conservative on EV rollouts so far. Stricter norms without sufficient flexibilities or transition credits could force higher compliance costs quickly. - Affordability at risk:

The company warns that aggressive targets could raise vehicle prices, hurting first-time buyers and slowing overall market growth. - India-specific realities:

Maruti is seeking a framework that better reflects Indian driving cycles, income levels, and infrastructure readiness, rather than mirroring global benchmarks too closely.

How other carmakers differ

Several competing OEMs—especially those with strong SUV portfolios, hybrids, or early EV investments—are relatively more comfortable with tighter norms because:

- Portfolio mix advantage:

Larger vehicles allow greater scope for hybridisation and electrification, improving fleet averages faster. - EV-led compliance strategy:

Companies with higher EV penetration can offset ICE emissions more easily through fleet averaging. - Global alignment:

Multinational OEMs often prefer regulatory consistency with other markets to leverage global platforms and technologies.

Why the PMO was approached

Approaching the PMO underscores the strategic importance of the issue. CAFE III will shape:

- Vehicle affordability

- Technology investments

- Employment across the supply chain

- India’s decarbonisation pathway

Maruti’s letter is less about resisting emission reduction and more about seeking recalibration—such as phase-in periods, segment-wise differentiation, super-credits for strong hybrids, or trading mechanisms.

The policy tightrope

For the government, the challenge is clear:

- Push decarbonisation hard enough to meet climate goals,

- Without pricing millions out of car ownership in a still price-sensitive market.

What to watch next

- Final CAFE III targets and timelines

- Inclusion of flexibilities (credits, banking, trading)

- Recognition of strong hybrids as a transition technology

- Alignment with India’s EV ecosystem readiness

Anuj Guglani, CEO WAF Group says, ‘The CAFE III debate is not Maruti vs regulation—it’s a mass-mobility-first model vs a technology-led transition model. Incentivising light weighting without serious consideration to Vehicle Safety and crash norms can be disastrous especially in India which sadly tops the world in road accident fatalities. At the same time, disregarding hybrids and giving more headroom to heavier cars and SUVs can also create a bias and dilute the emission control activity. How policymakers balance these aspects will define the next decade of India’s automotive growth where Safety has to be a Standard Inclusion!’