BEIJING, Jan 10 (Reuters) – Volkswagen Group (VOWG_p.DE) and Toyota Motor (7203.T) saw their share of the world’s largest auto market shrink last year, industry data showed on Wednesday, as legacy international automakers ceded ground to Chinese rivals.

VW’s two joint ventures in China with FAW and SAIC took a combined 14.2% share in sales terms in 2023, down from 14.8% in 2022, according to data from the China Passenger Car Association (CPCA). Sales of SAIC VW and FAW VW include brands of VW, Audi and Jetta.

Toyota’s China JVs with GAC and FAW held a combined 7.9% share, compared with 8.6% in 2022.

By comparison, Chinese electric vehicle giant BYD , which dethroned Tesla (TSLA.O) as the world’s top EV seller in the fourth quarter, led its home market with 12.5% share, up from 8.8% in 2022.

While the China ventures of VW and Toyota were among the top 10 automakers by sales last year, they were not among the top 10 new-energy vehicle vendors. BYD and Tesla were the top 2 NEV manufacturers in China.

The numbers epitomise how foreign legacy carmakers in China are losing out to local rivals and struggling to catch up on a shift to electric vehicles, amid a bruising price war and slowing demand as the country’s post-COVID economic recovery sputters.

Last year, Volkswagen‘s battery-electric vehicle deliveries grew 23.2% to 191,800 in China, while total sales grew 1.6% to 3.2 million cars.

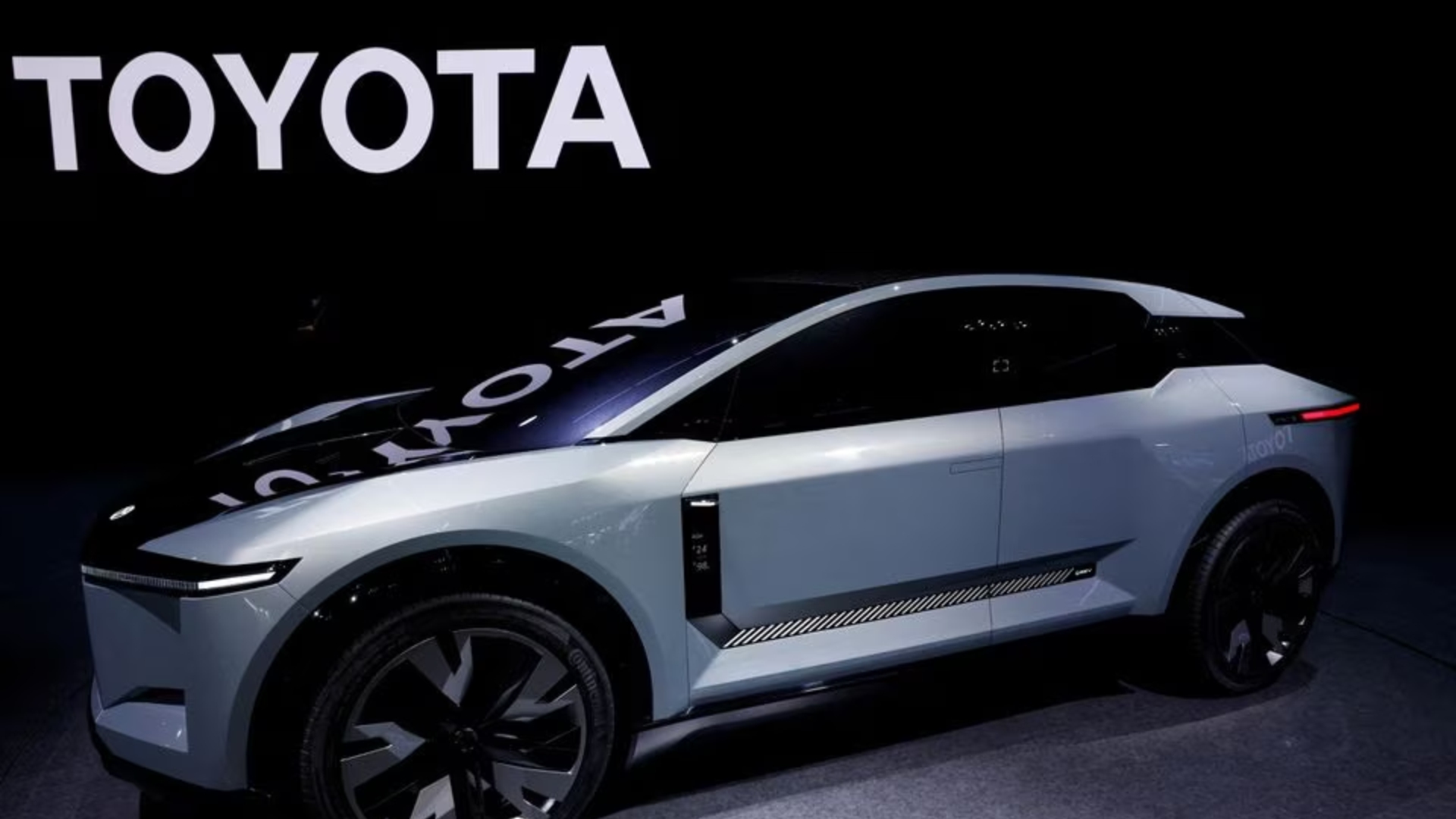

The German carmaker,with plans to launch a China-specific entry level electric platform, has been betting on local partnerships to help it in the country’s EV race. It struck a deal in July with Xpeng (9868.HK), one of the smaller Chinese EV makers.

Toyota, despite having avoided the kind of hit other Japanese automakers such as Nissan Motor (7201.T) Honda Motor (7267.T) have taken in China, also faces rising competition in the market where it has told dealers to extend output cuts at its JV with FAW, Reuters reported in November.

Reporting by Qiaoyi Li and Brenda Goh; Editing by Kim Coghill