BERLIN, Oct 26 (Reuters) – Car and truck makers from Volkswagen (VOWG_p.DE) to Nissan (7201.T) and Ford (F.N) have embraced the narrative that reducing carbon emissions in line with the Paris Agreement should be a key tenet of their business agenda.

Are they doing enough? Research shows their goals are still a far cry from what is needed, but the jury is out on whether automakers alone are responsible for the shortfall.

Consultancy firm Boston Consulting Group said in a report released last week that at least 90% of new passenger vehicles and 70% of trucks must be electric by 2030 in order to meet climate targets, echoing environmental groups like Greenpeace.

German luxury carmaker Daimler (DAIGn.DE), for example, has refrained from stating it will produce only electric vehicles by 2030 no matter what – instead it has emphasised it will be “ready to go all electric … where market conditions allow.”

“We will lead from the front. Is it realistic to turn 100% of the market by 2030? It would be a stretch,” Daimler’s CEO Ola Kaellenius told Reuters in an interview, adding he hoped to see countries and economic regions do their bit at the COP26 summit by synchronising their plans for electric vehicle rollouts.

Charging infrastructure is just one of many challenges standing between the auto industry, estimated by the International Energy Agency to be responsible for around 18% of all carbon emissions worldwide, and climate neutrality.

Others include getting rid of dirty fossil-fuel powered cars still on the roads, reducing emissions in battery production, and building storage systems for renewable energy to ensure the electricity used to charge electric cars is from renewable sources.

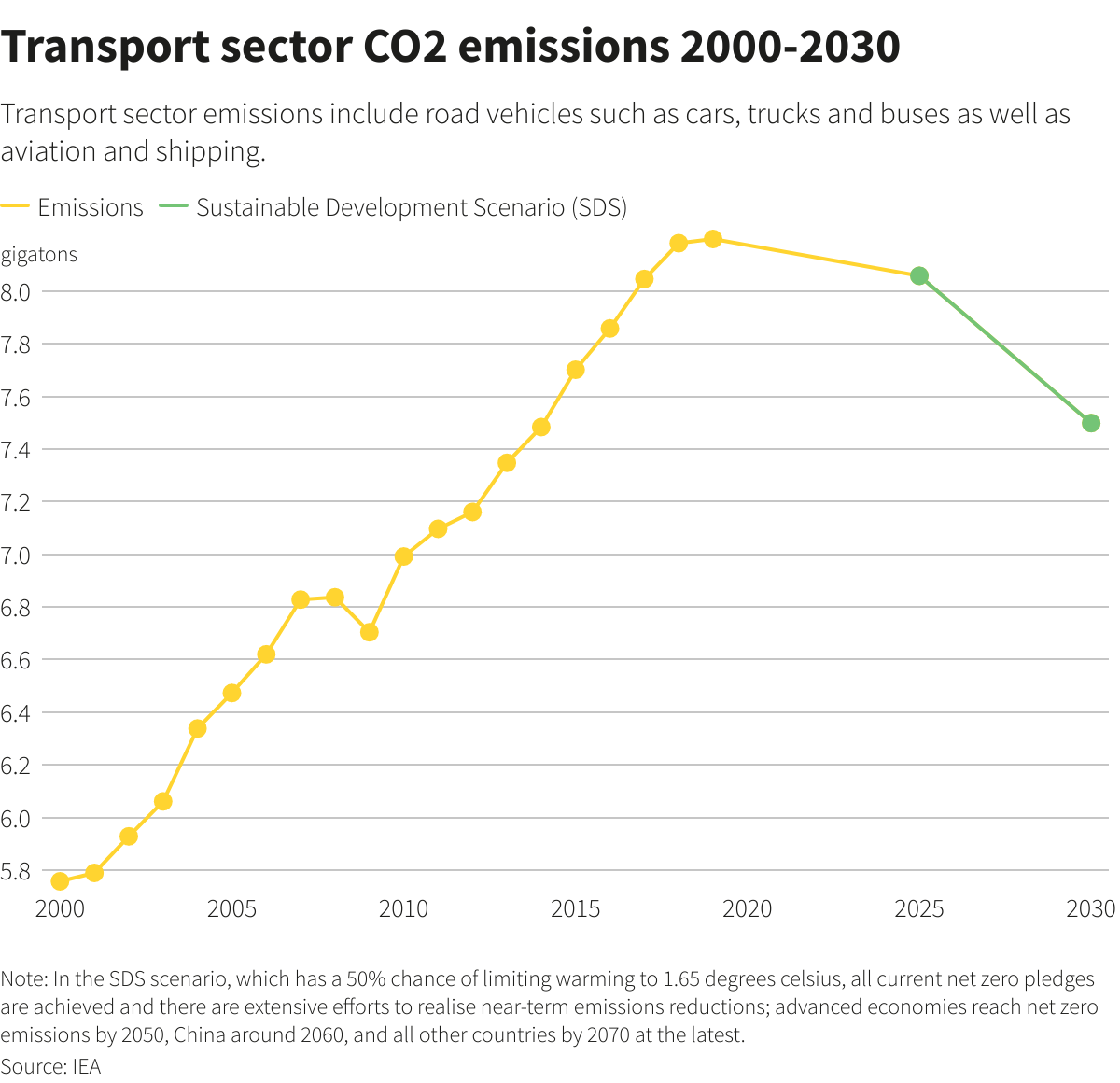

Under carbon reduction policies already agreed by governments and automakers, global CO2 emissions from vehicles are still set to rise over time, research by the International Council on Clean Transportation shows.

If policies under discussion are implemented, the growth trajectory stabilises but still does not fall, it said, highlighting growing demand for cars, buses and trucks in coming years due to population growth and increased economic activity in emerging markets.

While one in five vehicles sold in Europe last quarter were electrified, the share is much lower in the United States at around 2%. EVs are an even tinier slice of sales in less rich markets such as Latin America or Southeast Asia.

This includes German unions demanding clarity from Stellantis (STLA.MI) on its plans for Opel plants, and U.S. President Joe Biden facing pressure from the U.S. United Auto Workers’ union to provide more state support during the EV transition. read more

CARBON EMITTER

In the case of electric vehicles, the process of making batteries is also a significant carbon emitter, with a Volkswagen ID.3 for example generating nearly twice the emissions of a diesel equivalent in the production phase, according to company calculations.

Automakers like VW and Tesla (TSLA.O) are growing their offering of residential storage systems for clients to power vehicles through mechanisms like solar panels on their roofs – but the question of who is responsible for sourcing and distributing energy in public spaces is more contentious.

Even if automakers invest in public charging stations, ongoing problems with storage of renewable energy could force energy providers to rely on coal and natural gas to meet short-term demand, as recent volatility in energy markets has shown.

Lobby groups such as the European Automobile Manufacturers’ Association and the U.S.-based Alliance for Automotive Innovation have urged states to invest in renewable-based charging infrastructure, from public-private investments to fully state-funded projects.

But some environmental groups argue that relying on taxpayer funds is unfair as the networks would disproportionately benefit car companies and owners, as opposed to spending on public transport.

Another lingering problem is the diesel and gas cars still driving on roads beyond 2030, which will bump up the industry’s emissions well beyond the limit necessary to stay within the Paris Agreements’ bounds, researchers have said.

Even if half of all new cars sold in 2035 were zero emission – which climate goals set by BMW, General Motors (GM.N) and Nissan would account for – some 70% of vehicles on roads would still be burning fossil fuels, Boston Consulting has said.

“Even economies in the vanguard of the climate-change fight are therefore likely to fall short of decarbonisation targets.”