Revenue Rs. 12,328 Crore (+21%) & Normalized PAT at Rs.1,439 Crore (+20%)

Declares Interim Dividend of Rs. 110 Per Share (5500%)

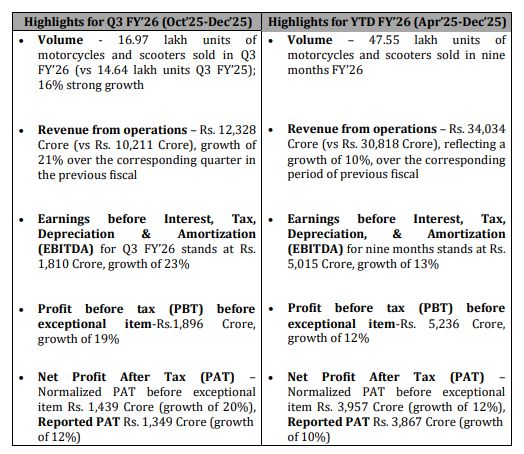

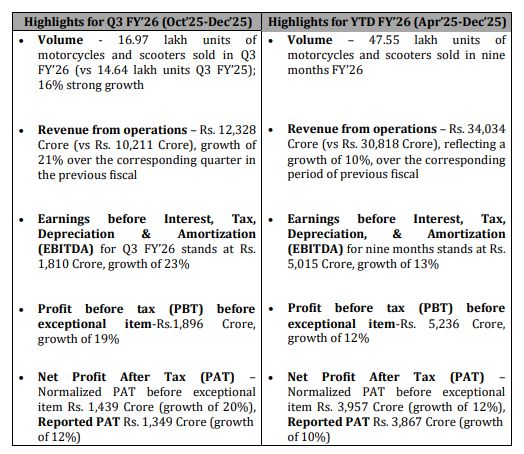

Hero MotoCorp, the world’s largest manufacturer of motorcycles and scooters, continues its strong financial performance for the third quarter (October – December 2025) of FY’26 and YTD FY’26 (April-December 2025), reporting highest ever Revenue & PAT.

The Company reported revenue from operations of Rs. 12,328 Crore for Q3 FY’26 (vs Rs. 10,211 Crore in the corresponding quarter of the previous fiscal), registering a healthy growth of 21% and highest ever parts revenue in the period.

EBITDA margin for the quarter stood at 14.7%, an expansion of 22 bps over the previous year, supported by favorable product mix, pricing and operational efficiencies.

During the quarter, the Company has considered the impact of four New Labour Codes, which came effect from November 21, 2025, resulting in a onetime charge of Rs.119 Crore. The same has been reported as an Exceptional item in the financial results.

Normalized PAT for Q3 FY’26 before considering the onetime impact of exceptional item stands at Rs. 1,439 Crore, a growth of 20% over previous year.

On a consolidated basis, Revenue and PAT for the quarter stood at Rs. 12,487 Crore and Rs. 1,275 Crore, respectively.

Reinforcing its commitment to shareholder returns, the company has declared an interim dividend of Rs.110 per share (5500%).

Driven by its highest ever festive season in Q3 FY’26, Hero MotoCorp delivered 16% yearon-year (Y-o-Y) volume growth across its portfolio. Performance during the quarter was underpinned by new model launches across all categories. In the ICE scooter segment, solid growth of 55% was witnessed.

Hero MotoCorp’s growth was further strengthened by positive performance in both EV and Global business. VIDA, Hero MotoCorp’s Emerging Mobility business, continued its strong growth momentum, closing the quarter with 11% market share. The Company sustained a positive trajectory across its key international markets with 41% growth in exports, supported by new market entries and portfolio expansion. Highest quarterly revenue from Part, Accessories, and Merchandising (PAM) business at Rs. 1,673 Crore was also reported.

Commenting on the Company’s performance, Vivek Anand, Chief Financial Officer (CFO), Hero MotoCorp, said, “Hero MotoCorp delivered a positive growth performance in Q3 FY’26 with healthy double‐digit growth in volumes and retailmomentum. Steady focus on operational excellence, product mix optimization, consumer‐centricity and innovation remained our corepillars enabling consistent financial performance during the quarter. Conducive macro‐economic factors and favorable GST 2.0 tailwind helped in revival of rural demand which further drove consumer traction for motorcycles and growth for the economy.”