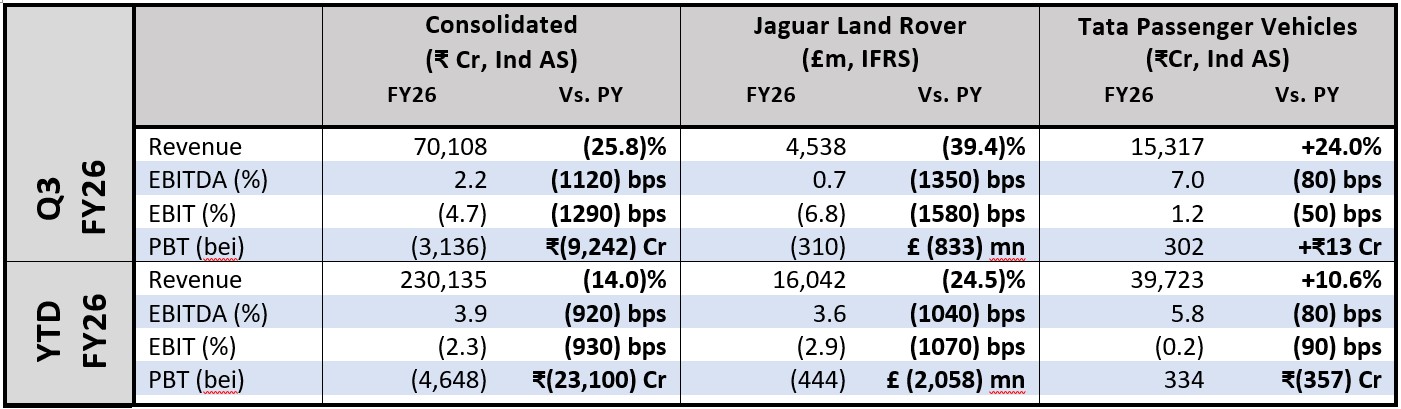

Tata Motors Passenger Vehicles Limited (formerly Tata Motors Limited) Consolidated Q3 FY26 Results

JLR CYBER INCIDENT IMPACT CARRIED OVER IN Q3 RESULTS, POISED FOR STRONG RECOVERY IN Q4

Consolidated Revenue ₹70.1K Cr (-25.8%), EBITDA at ₹1.5K Cr,

PBT (bei) ₹(3.1)K Cr (-9.2K Cr), Free Cash Flows ₹(17.9)K Cr (vs PY)

- JLR Revenue £4.5bn down 39.4%, EBITDA at 0.7% (-1350 bps), EBIT at -6.8% (-1580 bps)

- Tata PV Revenue ₹15.3K Cr, up 24%, EBITDA at 7.0% (-80 bps), EBIT at 1.2% (-50bps)

Mumbai, February : Tata Motors Passenger Vehicles Ltd. (TMPVL) announced its results for quarter ending December 31, 2025.

Performance:

Consolidated: TMPVL delivered revenues of ₹70.1K Cr (down 25.8%) and EBIT of ₹(3.3)K Cr (down ₹11.0K Cr). The performance continued to be impacted significantly by the cyber incident at JLR, as indicated earlier. The domestic performance improved QoQ on account of higher volumes and incentives. PBT (bei) for Q3 FY26 stood at ₹(3.1)K Cr. Exceptional items of ₹1.6K Cr for Q3 FY26 majorly comprised of expenses pertaining to JLR Cyber Incident, New Labor Code and Stamp duty of ₹0.8K Cr, ₹0.4K Cr and ₹0.4K Cr, respectively, resulting in PBT of ₹(4.7)K Cr. Net Profit in Q3 FY26 was ₹(3.5)K Cr post recognizing a deferred tax asset at JLR. For YTD FY26, the Company reported a PBT (bei) of ₹(4.6)K Cr, a decline of ₹23.1K Cr over the previous year. The Consolidated Free Cash Flow for the quarter was negative at ₹(17.9)K Cr driven by lower volumes and adverse working capital impact at JLR. Net Debt as on December 31, 2025 was ₹39.4K Cr.

Looking Ahead:

The overall global demand continues to remain challenging. We will step up our brand-led actions at JLR to drive up demand for our products and execute enterprise missions programme aimed at enhancing savings and cash flows. Domestic business continues to witness robust demand, and we will accelerate growth through exciting launches and innovations. Overall, we expect a sharp improvement in Q4, led by normalization of JLR volumes.

Dhiman Gupta, Chief Financial Officer, TMPVL said:

“Overall, it was a challenging quarter as anticipated on account of carryover impact of Cyber Incident at JLR, while domestic business delivered robust revenue and margin improvement QoQ. We expect performance to significantly improve in Q4 with recovery at JLR and continuing growth in domestic market share. We are well poised to seize the opportunities and drive growth through an exciting product portfolio and focused approach to achieve margin improvement”.

JAGUAR LAND ROVER (JLR)

Financial Highlights

- Q3 FY26 Revenue at £4.5bn (-39.4%), EBITDA 0.7% (-1350 bps), EBIT -6.8% (-1580 bps), PBT (bei) £(310)m

- YTD FY26 Revenue at £16.0bn (-24.5%), EBITDA 3.6% (-1040 bps), EBIT -2.9% (-1070 bps), PBT (bei) £(444)m

- Volumes impacted following the cyber incident and the time taken thereafter to distribute vehicles globally, as vehicle production returned to normal levels by mid-November

- Volumes also impacted by planned wind down of legacy Jaguar models ahead of new Jaguar launch, a deterioration of market conditions in China, and ongoing incremental US tariffs impacting JLR’s US exports

- EBIT guidance reaffirmed at 0% to 2% for FY26

- Free cash outflow for the quarter was £(1.5)bn and £(3.1)bn YTD

- Closing Cash balance was £1.9bn and net debt £3.3bn, with gross debt of £5.2bn

- Total liquidity as at December 31, 2025 was £6.6bn, including the undrawn £1.7bn RCF, an undrawn £1.5bn bridge facility and an undrawn £1.5bn UKEF guaranteed commercial loan.

- Business well positioned for significantly improved performance in Q4

Operational Highlights

- New Jaguar prototype passenger rides received overwhelmingly positive reaction from global media

- Range Rover SV Black, epitomising the most exclusive, luxurious and crafted models, debuted in USA at Design Miami

- Defender shows unrivalled capability by winning the Dakar Rally Stock Class, with Defender D7X-R vehicles placed first and second, in Defender’s debut year in the world’s toughest off-road challenge

JLR’s revenue for the quarter was £4.5bn, down 39% versus Q3 FY25 and £16.0bn YTD, down 24% YoY. This was largely driven by reduction in wholesale volumes, which were impacted following the cyber incident, with production only returning to normal levels by mid-November and the time being required thereafter to distribute vehicles globally. Volumes and profitability were also both impacted year-on-year by the continued planned wind down of legacy Jaguar models ahead of the new Jaguar launch, and deterioration of market conditions in China. Profitability was also impacted by the cyber incident, ongoing incremental US tariffs and increased VME. Loss before tax and exceptional items was £(310)m for Q3 and £(444)m YTD, down from a profit of £523m and £1.6bn respectively, a year ago. EBIT margin was (6.8)% for the third quarter, down from 9.0% a year ago, and (2.9)% YTD, down from 7.8% YTD last year. Exceptional items of £74m in the quarter includes £64m of costs related to the cyber incident. Loss after tax in the quarter was £(298)m, compared to a profit of £375m in the same quarter a year ago. YTD, the loss after tax was £(609)m compared to a profit of £1.2bn this time last year.

Looking ahead

JLR remains resilient and well placed to address the economic, geopolitical and policy challenges the industry faces. Investment spend is expected to remain at £18bn over the five-year period from FY24. In light of the challenges faced, FY26 guidance is reaffirmed, with EBIT margin in the range of 0% to 2% and free cash outflow of £2.2bn to £2.5bn.

PB Balaji, Chief Executive Officer, said:

“Q3 was a challenging quarter for JLR with performance impacted by the production shutdown we initiated in response to the cyber incident, the planned wind down of legacy Jaguar, and US tariffs. Thanks to the commitment of our dedicated teams, we returned vehicle production to normal levels by mid-November, and we are focused on building our business back stronger. While the external environment remains volatile, we expect performance to improve significantly in the fourth quarter and we have clear plans to manage global challenges. We have a resilient business and remain focused on transformation. 2026 is set to be an exciting year for JLR as we develop our next generation vehicles, including the launch of Range Rover Electric and the unveiling of the first new Jaguar.”

TATA PASSENGER VEHICLES (TATA PV)

Financial Highlights

- Q3 FY26 revenue at ₹ 15.3K Cr (+24%), EBITDA 7.0% (-80 bps), EBIT 1.2% (-50bps), PBT (bei) ₹ 0.3K Cr

- YTD FY26 revenue at ₹ 39.7K Cr (+10.6%), EBITDA 5.8% (-80 bps), EBIT -0.2% (-90 bps), PBT (bei) ₹ 0.3K Cr

- Domestic PV + EV business reported FCF of ₹0.3K Cr in Q3 FY26

- Closing Cash balance for domestic business at ₹8.9K Cr with gross debt of ₹3.8K Cr, resulting in Net Cash position of ₹5.1K Cr

Business Highlights

- Vahan market share grew to 13.8% in Q3 FY26 (+100 bps QoQ), secured #2 position in Q3 basis Vahan

- EV Vahan market share continues to grow at 43.6% following highest ever registrations in Q3

- Alternative powertrains mix continues to be healthy. EV penetration at 14%, CNG at 28% in Q3 FY26

- Launched all new SIERRA, retaining its legendary heritage and distinctive DNA while embracing modernity; over 70,000 order confirmations on Day 1 of bookings opening

- Introduced Harrier and Safari in petrol powertrains, with all new all-new 1.5L HYPERION Turbo-GDi engine – redefining the premium SUV segment

- Launched New Tata Punch, combining unmatched power, superior comfort, cutting-edge technology, and muscular styling under its unique signature “Command Max”

- Re-entered ICE fleet segments with Petrol and Twin-Cylinder CNG variants of XPRES

- ev surpassed 250,000 cumulative EV sales, reaffirming leadership in India’s Electric Mobility charge

PV and EV volumes during the quarter were at 171K units (+22% YoY) driven by impact of reduction in GST rates and robust performance of products. Revenues in Q3 FY26 were up 24% YoY at ₹ 15.3K Cr, while EBITDA margins were at 7.0%, down 80 bps YoY. The EBIT margins stood at 1.2% (-50 bps YoY), as adverse realisations, commodities, fixed costs, D&A offset the impact of favourable volumes and incentive accrual. EBITDA margins and EBIT margins improved 120 bps and 100 bps QoQ.

Looking ahead

Looking ahead, we remain confident about the PV industry’s growth in light of positive demand momentum seen post GST 2.0.

With our product launches & interventions commencing deliveries in Q4 and a strong slate of upcoming launches, Tata Motors PV is well poised to accelerate its growth trajectory in FY27.

Shailesh Chandra, Managing Director & CEO, Tata Motors Passenger Vehicles Limited said:

“In Q3 FY26, we recorded our highest‑ever quarterly wholesales at 171k units, while retail sales crossed the 200k mark for the first time, driven by strong demand tailwinds from GST 2.0 and a robust festive season. With strengthened value proposition for our products, we witnessed robust demand during the quarter, with Nexon emerging as the highest-selling model in India in Q3, while Punch also saw enhanced volumes. In EVs, we continued to sustain our growth trajectory with our highest-ever quarterly retails. Improved market traction also propelled our revenues to a new quarterly peak, registering a 24% year‑on‑year growth. The quarter was also highlighted by major product launches, including the launch of the eagerly awaited Sierra, which has received an exceptional customer response, and the unveiling of the Harrier and Safari in petrol. Earlier this month, we also launched the popular Punch in a new avatar, which has been received well by the market. Going forward, we expect to accelerate growth with a strong product pipeline, healthy inventory levels, and sustained demand across segments, while strengthening our margin trajectory.”