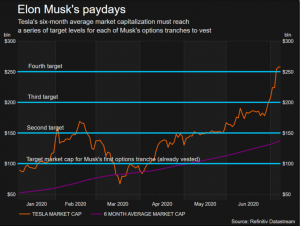

(Reuters) – Tesla Inc’s blistering stock rally is putting Chief Executive Elon Musk in reach of a payday potentially worth $1.8 billion, his second jackpot from the electric car maker in about two months.

Musk has already achieved targets related to Tesla’s financial growth that are also required in order to vest the approaching options tranche.

Each tranche gives Musk the option to buy 1.69 million Tesla shares at $350.02 each. At Tesla’s current stock price of $1,397, Musk would theoretically be able to sell the shares related to the tranche that vested in May and the upcoming tranche for a combined profit of over $3.5 billion, or $1.8 billion per tranche.

Musk’s first tranche was worth about $700 million in May, when it vested, but its value has since increased along with Tesla’s stock price.

Tesla has surged 500% over the past year as the company increased sales of its Model 3 sedan.

Tesla last week reported higher-than-expected second-quarter vehicle deliveries, defying plummeting sales in the wider auto industry as the coronavirus pandemic slammed the global economy.

The solid delivery numbers heightened expectations of a profitable second quarter, which would mark four consecutive profitable quarters, a first for Tesla, and a key hurdle to be added to the S&P 500 index.

Musk, who is also the majority owner and CEO of the SpaceX rocket maker, receives no salary, only the options in his pay package. A full payoff of all tranches would surpass anything previously granted to U.S. executives.

When Tesla unveiled Musk’s pay package, it said he could theoretically reap as much as $55.8 billion if no new shares were issued. However, Tesla has since issued shares to compensate employees, and also sold shares in secondary offers, including a $2 billion stock sale in February.

Reporting by Noel Randewich; Editing by Alden Bentley and David Gregorio